Category Archives: Real Estate

The Benefits of Downsizing When You Retire

If you’re taking a look at your expenses as you retire, saving money where you can has a lot of appeal. One long-standing, popular way to do that is by downsizing to a smaller home.

When you think about cutting down on your spending, odds are you think of frequent purchases, like groceries and other goods. But when you downsize your house, you often end up downsizing the bills that come with it, like your mortgage payment, energy costs, and maintenance requirements. Realtor.com shares:

“A smaller home typically means lower bills and less upkeep. Then there’s the potential windfall that comes from selling your larger home and buying something smaller.”

That windfall is thanks to your home equity. If you’ve been in your house for a while, odds are you’ve built up a considerable amount of equity. And that equity is something you can use to help you buy a home that better fits your needs today. Daniel Hunt, CFA at Morgan Stanley, explains:

“Home equity can be a significant source of wealth for retirees, often representing a large portion of their net worth. . . . Retirement planning can be complex, but your home equity shouldn’t be overlooked.”

And when you’re ready to use that equity to fuel your next move, your real estate agent will be your guide through every step of the process. That includes setting the right price for your current house when you sell, finding the home that best fits your evolving needs, and understanding what you can afford at today’s mortgage rate.

What This Means for You

If you’re thinking about downsizing, ask yourself these questions:

- Do the original reasons I bought my current house still stand, or have my needs changed since then?

- Do I really need and want the space I have right now, or could somewhere smaller be a better fit?

- What are my housing expenses right now, and how much do I want to try to save by downsizing?

Then, meet with a real estate agent to get an answer to this one: What are my options in the market right now? A local real estate agent can walk you through how much equity you have in your house and how it positions you to win when you downsize.

Bottom Line

Want to save money in retirement? Consider downsizing – it could really help you out. When you’re ready, let’s connect about your goals in the housing market this year.

Category Archives: Real Estate

Why Access Is So Important When Selling Your House

If you’re gearing up to sell your house this spring, one of the early conversations you’ll have with your agent is about how much access you want to give buyers. And you may not realize just how important it is to make your house easy to tour.

Spring is the peak homebuying season, so opening up your house to as many showings as possible can really help you capitalize on all the extra buyer activity we see at this time of year.

Since buyer competition ramps up in the spring, buyers are going to want to move fast to see your house once they find your listing. And, if they see it and fall in love with it at a time they know they’re competing with other buyers, you may be more likely to get the offer you’re looking for on your home.

It’s understandable you want to keep the disruptions to your own schedule to a minimum, and you may be stressed about having to keep it clean, but it’s worth it. As an article from Investopedia explains:

“If someone wants to view your house, you need to accommodate them, even if it inconveniences you. Clean and tidy the house before every single visit. A buyer won’t know or care if your house was clean last week. It’s a lot of work, but stay focused on the prize.”

To figure out what’s best for you, your agent will walk you through options like the ones below. This list breaks things down, starting with what’s most convenient for buyers and getting less buyer-focused as the list goes on:

- Lockbox on the Door – A key is available via a lockbox, which makes it easy for agents to show the home to potential buyers. This gives the most flexibility because the key is on-site and convenient.

- Providing a Key to the Home – An agent would have to stop by an office to pick up the key with this option. This is still pretty convenient for showings, but not quite as simple.

- Open Access with a Phone Call – You allow a showing with just a phone call’s notice, which can be great for someone who sees your house while driving by.

- By Appointment Only – This gives you a more advanced warning so you can get the house tidied up and be sure you have somewhere else you can go in the meantime. But it’s also a bit more restrictive.

- Limited Access – You might go this route if you only want to have your house available on specific days or at certain times of day. But realize this is the most difficult and least flexible of the choices.

As an article from U.S. News Real Estate says:

“Buyers like to see homes on their schedule, which often means evenings and weekends. Plus, they want to be able to tour a home soon after they find it online, especially if they’re competing with other buyers. If your home can be shown with little or no notice, more prospective buyers will see it. If you require 24 hours’ notice, they may choose to skip your home altogether.”

Your agent is going to help you find the right path forward based on your schedule and what’s working for other sellers in your area. And if you’ve got a hardline on granting buyers more access or have interested out of town buyers that just can’t be there in person, your agent will get creative and help you explore other options like video tours, virtual showings, and more.

Bottom Line

When it comes to selling your house, you want to be sure to get as much buyer activity as you can. Let’s connect to talk about which level of access helps make that possible.

Category Archives: Real Estate

Why There Won’t Be a Recession That Tanks the Housing Market

There’s been a lot of recession talk over the past couple of years. And that may leave you worried we’re headed for a repeat of what we saw back in 2008. Here’s a look at the latest expert projections to show you why that isn’t going to happen.

According to Jacob Channel, Senior Economist at LendingTree, the economy’s pretty strong:

“At least right now, the fundamentals of the economy, despite some hiccups, are doing pretty good. While things are far from perfect, the economy is probably doing better than people want to give it credit for.”

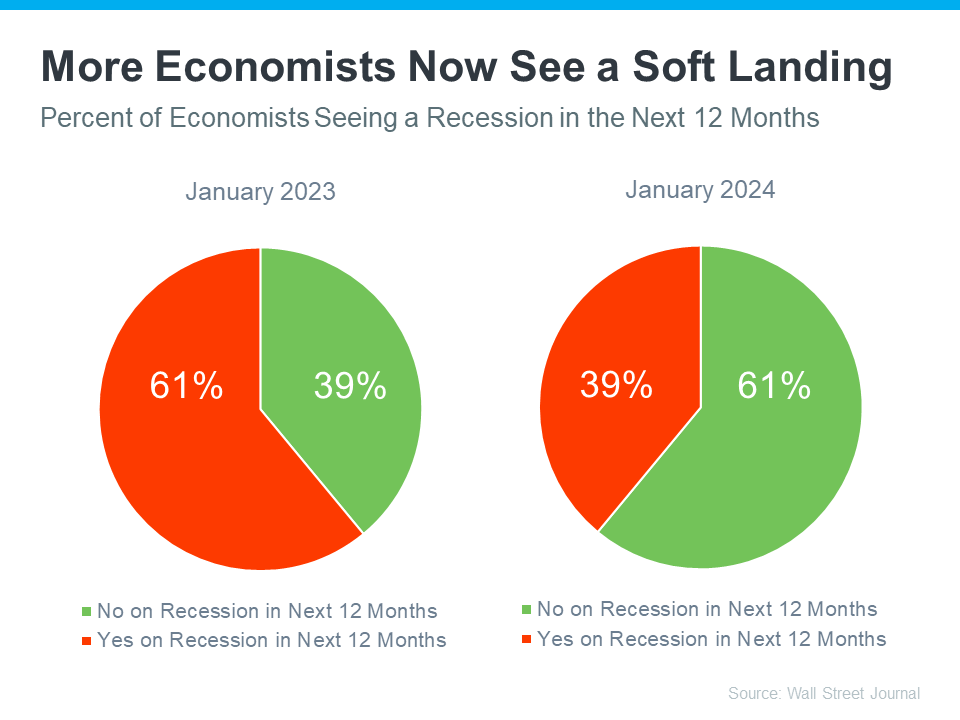

That might be why a recent survey from the Wall Street Journal shows only 39% of economists think there’ll be a recession in the next year. That’s way down from 61% projecting a recession just one year ago (see graph below):

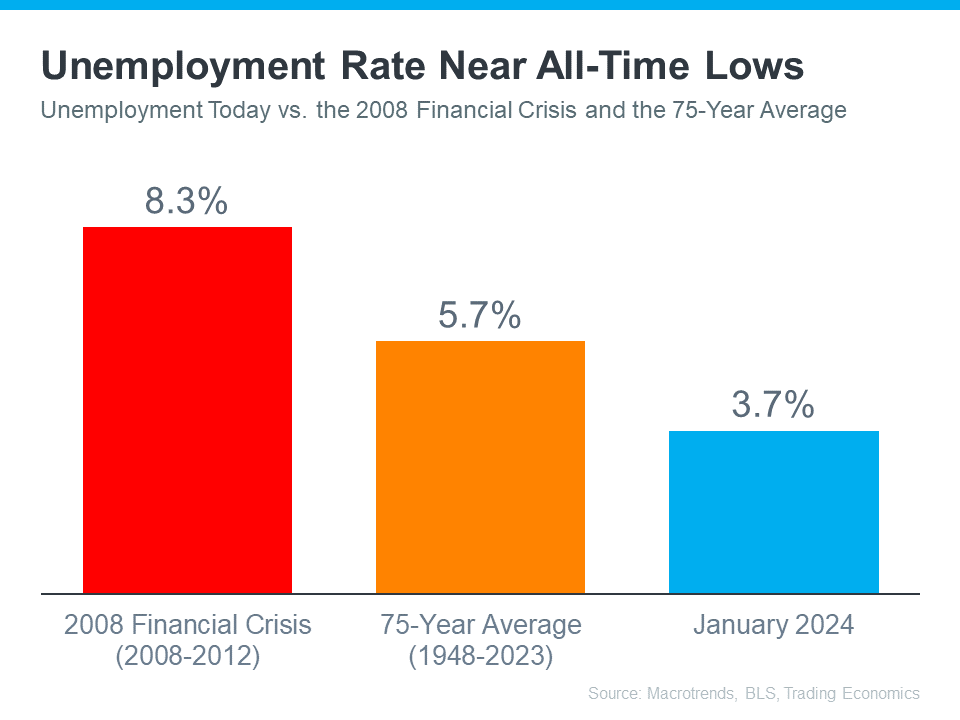

Most experts believe there won’t be a recession in the next 12 months. One reason why is the current unemployment rate. Let’s compare where we are now with historical data from Macrotrends, the Bureau of Labor Statistics (BLS), and Trading Economics. When we do, it’s clear the unemployment rate today is still very low (see graph below):

The orange bar shows the average unemployment rate since 1948 is about 5.7%. The red bar shows that right after the financial crisis in 2008, when the housing market crashed, the unemployment rate was up to 8.3%. Both of those numbers are much larger than the unemployment rate this January (shown in blue).

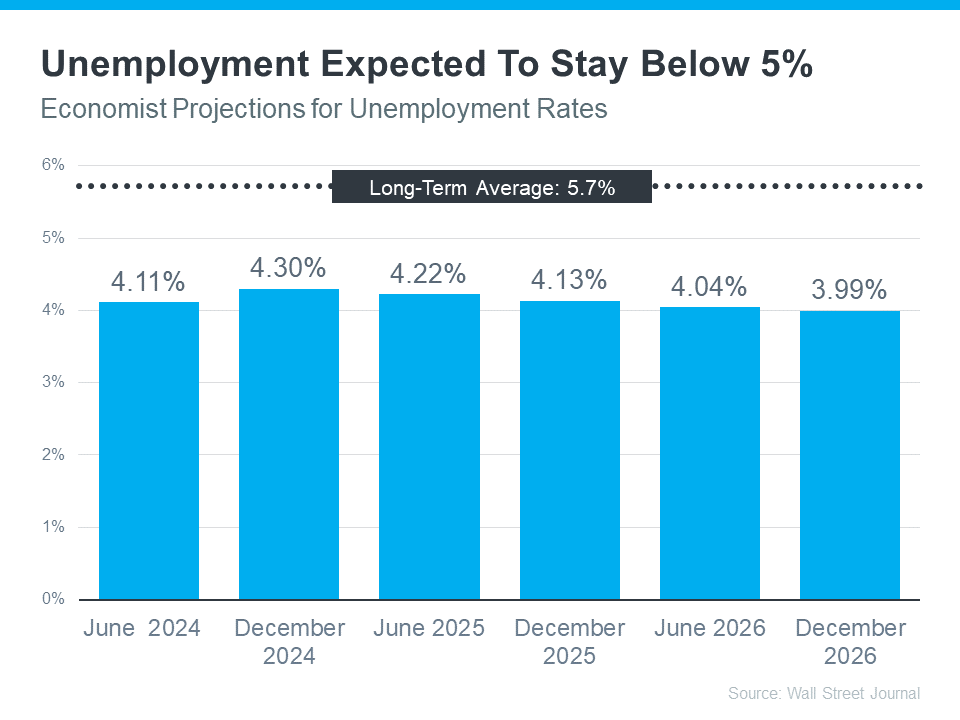

But will the unemployment rate go up? To answer that, look at the graph below. It uses data from that same Wall Street Journal survey to show what the experts are projecting for unemployment over the next three years compared to the long-term average (see graph below):

As you can see, economists don’t expect the unemployment rate to even come close to the long-term average over the next three years – much less the 8.3% we saw when the market last crashed.

Still, if these projections are correct, there will be people who lose their jobs next year. Anytime someone’s out of work, that’s a tough situation, not just for the individual, but also for their friends and loved ones. But the big question is: will enough people lose their jobs to create a flood of foreclosures that could crash the housing market?

Looking ahead, projections show the unemployment rate will likely stay below the 75-year average. That means you shouldn’t expect a wave of foreclosures that would impact the housing market in a big way.

Bottom Line

Most experts now think we won’t have a recession in the next year. They also don’t expect a big jump in the unemployment rate. That means you don’t need to fear a flood of foreclosures that would cause the housing market to crash.

Category Archives: Real Estate

What To Know About Credit Scores Before Buying a Home

If you want to buy a home, you should know your credit score is a critical piece of the puzzle when it comes to qualifying for a mortgage. Lenders review your credit to see if you typically make payments on time, pay back debts, and more. Your credit score can also help determine your mortgage rate. An article from US Bank explains:

“A credit score isn’t the only deciding factor on your mortgage application, but it’s a significant one. So, when you’re house shopping, it’s important to know where your credit stands and how to use it to get the best mortgage rate possible.”

That means your credit score may feel even more important to your homebuying plans right now since mortgage rates are a key factor in affordability. According to the Federal Reserve Bank of New York, the median credit score in the U.S. for those taking out a mortgage is 770. But that doesn’t mean your credit score has to be perfect. The same article from US Bank explains:

“Your credit score (commonly called a FICO Score) can range from 300 at the low end to 850 at the high end. A score of 740 or above is generally considered very good, but you don’t need that score or above to buy a home.”

Working with a trusted lender is the best way to get more information on how your credit score could factor into your home loan and the mortgage rate you’re able to get. As FICO says:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single “cutoff score” used by all lenders and there are many additional factors that lenders may use to determine your actual interest rates.”

If you’re looking for ways to improve your score, Experian highlights some things you may want to focus on:

- Your Payment History: Late payments can have a negative impact by dropping your score. Focus on making payments on time and paying any existing late charges quickly.

- Your Debt Amount (relative to your credit limits): When it comes to your available credit amount, the less you’re using, the better. Focus on keeping this number as low as possible.

- Credit Applications: If you’re looking to buy something, don’t apply for additional credit. When you apply for new credit, it could result in a hard inquiry on your credit that drops your score.

Bottom Line

Finding ways to make your credit score better could help you get a lower mortgage rate. If you want to learn more, talk to a trusted lender.

Category Archives: Real Estate

Why We Aren’t Headed for a Housing Crash

If you’re holding out hope that the housing market is going to crash and bring home prices back down, here’s a look at what the data shows. And spoiler alert: that’s not in the cards. Instead, experts say home prices are going to keep going up.

Today’s market is very different than it was before the housing crash in 2008. Here’s why.

It’s Harder To Get a Loan Now – and That’s Actually a Good Thing

It was much easier to get a home loan during the lead-up to the 2008 housing crisis than it is today. Back then, banks had different lending standards, making it easy for just about anyone to qualify for a home loan or refinance an existing one.

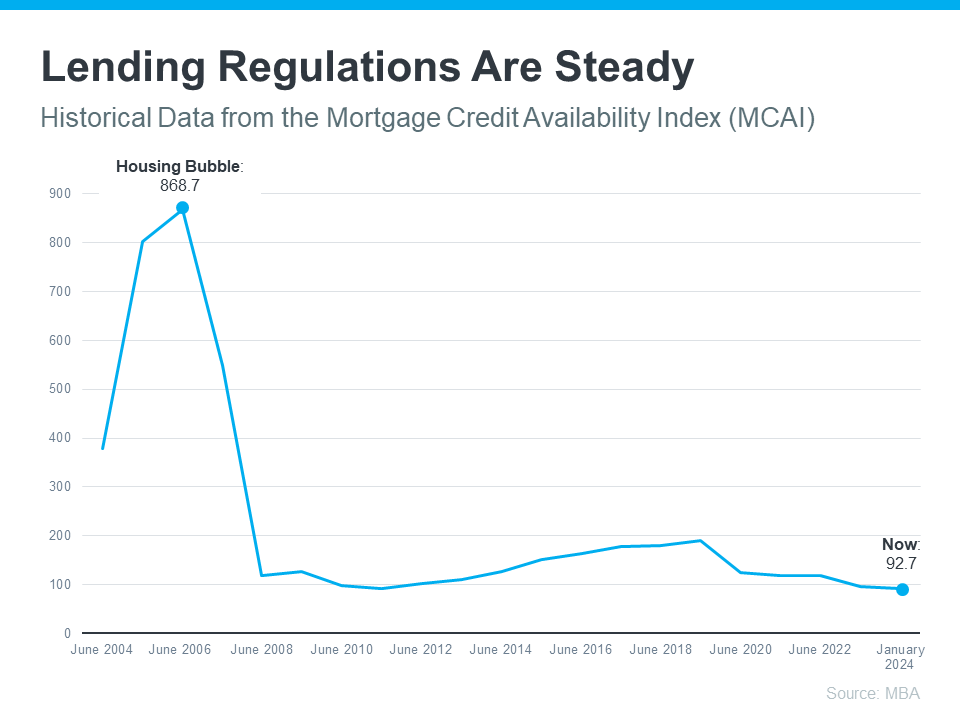

Things are different today. Homebuyers face increasingly higher standards from mortgage companies. The graph below uses data from the Mortgage Bankers Association (MBA) to show this difference. The lower the number, the harder it is to get a mortgage. The higher the number, the easier it is:

The peak in the graph shows that, back then, lending standards weren’t as strict as they are now. That means lending institutions took on much greater risk in both the person and the mortgage products offered around the crash. That led to mass defaults and a flood of foreclosures coming onto the market.

There Are Far Fewer Homes for Sale Today, so Prices Won’t Crash

Because there were too many homes for sale during the housing crisis (many of which were short sales and foreclosures), that caused home prices to fall dramatically. But today, there’s an inventory shortage – not a surplus.

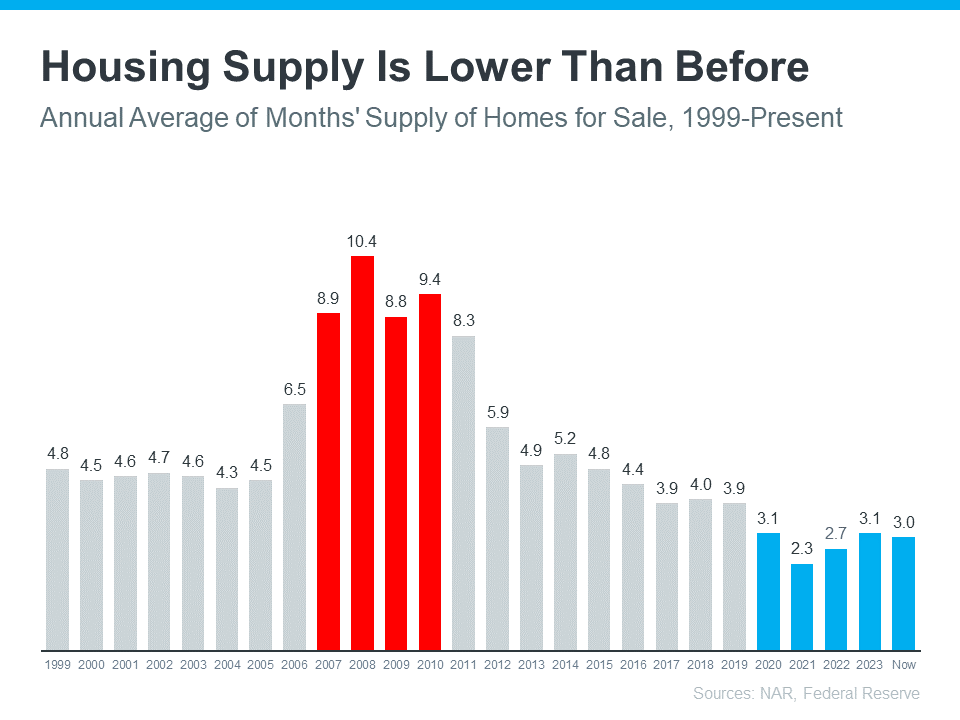

The graph below uses data from the National Association of Realtors (NAR) and the Federal Reserve to show how the months’ supply of homes available now (shown in blue) compares to the crash (shown in red):

Today, unsold inventory sits at just a 3.0-months’ supply. That’s compared to the peak of 10.4 month’s supply back in 2008. That means there’s nowhere near enough inventory on the market for home prices to come crashing down like they did back then.

People Are Not Using Their Homes as ATMs Like They Did in the Early 2000s

Back in the lead up to the housing crash, many homeowners were borrowing against the equity in their homes to finance new cars, boats, and vacations. So, when prices started to fall, as inventory rose too high, many of those homeowners found themselves underwater.

But today, homeowners are a lot more cautious. Even though prices have skyrocketed in the past few years, homeowners aren’t tapping into their equity the way they did back then.

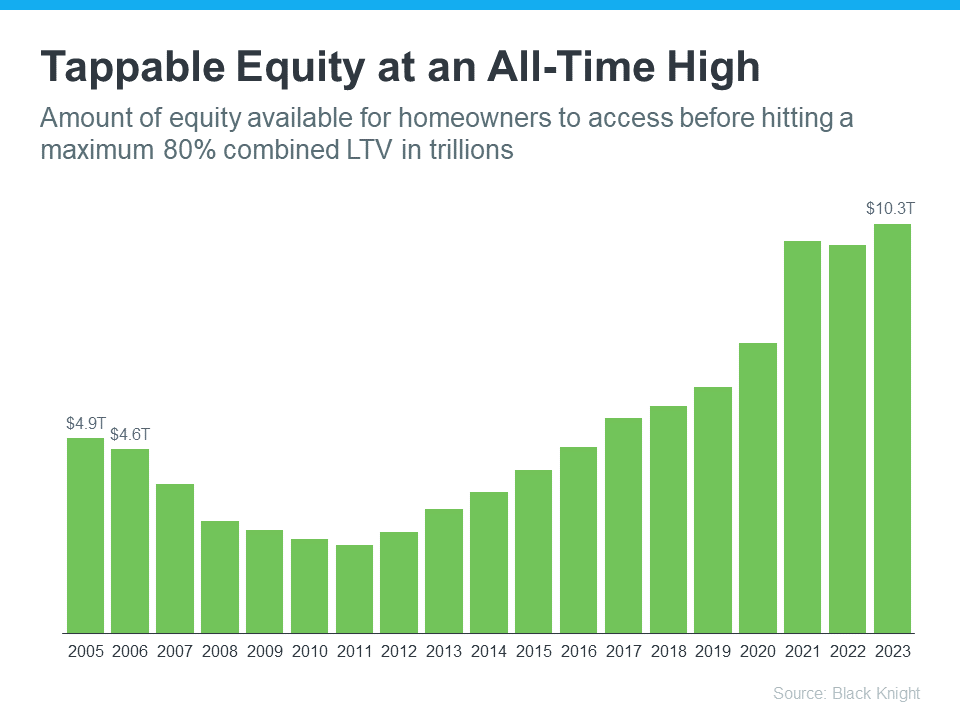

Black Knight reports that tappable equity (the amount of equity available for homeowners to access before hitting a maximum 80% loan-to-value ratio, or LTV) has actually reached an all-time high:

That means, as a whole, homeowners have more equity available than ever before. And that’s great. Homeowners are in a much stronger position today than in the early 2000s. That same report from Black Knight goes on to explain:

“Only 1.1% of mortgage holders (582K) ended the year underwater, down from 1.5% (807K) at this time last year.”

And since homeowners are on more solid footing today, they’ll have options to avoid foreclosure. That limits the number of distressed properties coming onto the market. And without a flood of inventory, prices won’t come tumbling down.

Bottom Line

While you may be hoping for something that brings prices down, that’s not what the data tells us is going to happen. The most current research clearly shows that today’s market is nothing like it was last time.

Category Archives: Real Estate

Why You Want an Agent’s Advice for Your Move

No matter how you slice it, buying or selling a home is a big decision. And when you’re going through any change in your life and you need some guidance, what do you do? You get advice from people who know what they’re talking about.

Moving is no exception. You need insights from the pros to help you feel confident in your decision. Freddie Mac explains it like this:

“As you set out to find the right home for your family, be sure to select experienced, trusted professionals who will help you make informed decisions and avoid pitfalls.”

And while perfect advice isn’t possible – not even from the experts, what you can get is the very best advice out there.

The Power of Expert Advice

For example, let’s say you need an attorney. You start off by finding an expert in the type of law required for your case. Once you do, they won’t immediately tell you how the case is going to end, or how the judge or jury will rule. But what a good attorney can do is walk you through the most effective strategies based on their experience and help you put a plan together. They’ll even use their knowledge to adjust that plan as new information becomes available.

The job of a real estate agent is similar. Just like you can’t find a lawyer to give you perfect advice, you won’t find a real estate professional who can either. That’s because it’s impossible to know everything that’s going to happen throughout your transaction. Their role is to give you the best advice they can.

To do that, an agent will draw on their experience, industry knowledge, and market data. They know the latest trends, the ins and outs of the homebuying and selling processes, and what’s worked for other people in the same situation as you.

With that expertise, a real estate advisor can anticipate what could happen next and work with you to put together a solid plan. Then, they’ll guide you through the process, helping you make decisions along the way. That’s the very definition of getting the best – not perfect – advice. And that’s the power of working with a real estate advisor.

Bottom Line

If you’re looking to buy or sell a home, you want an expert on your side to help you each step of the way. Let’s connect so you have advice you can count on.

Category Archives: Real Estate

Why Today’s Housing Supply Is a Sweet Spot for Sellers

Wondering if it still makes sense to sell your house right now? The short answer is, yes. And if you look at the current number of homes for sale, you’ll see two reasons why.

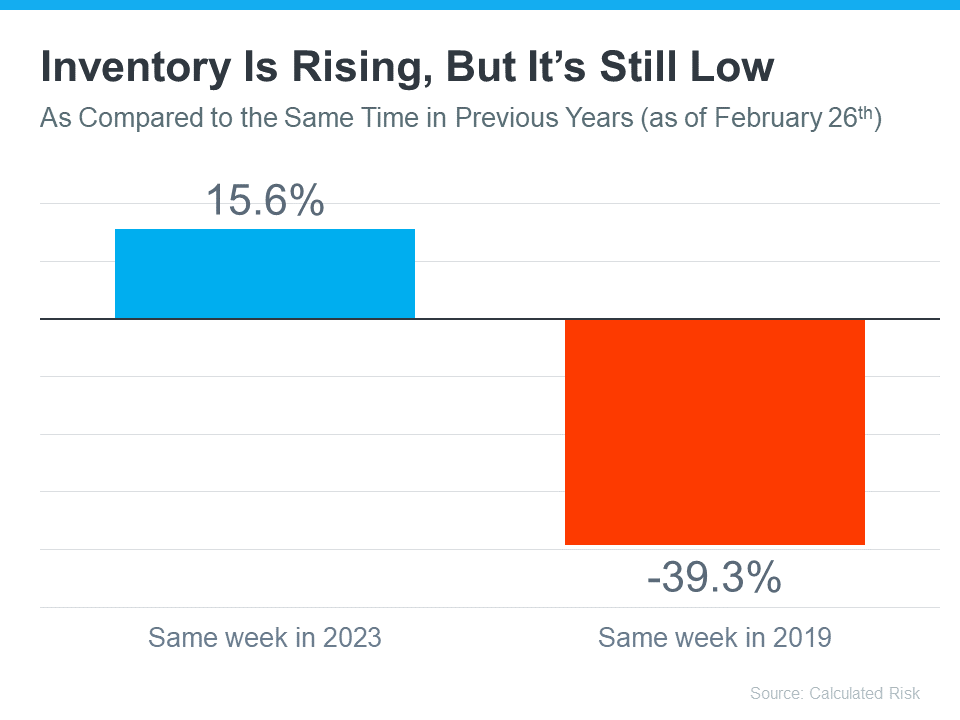

An article from Calculated Risk shows there are 15.6% more homes for sale now compared to the same week last year. That tells us inventory has grown. But going back to 2019, the last normal year in the housing market, there are nearly 40% fewer homes available now:

Here’s a breakdown of how this benefits you when you sell.

1. You Have More Options for Your Move

Are you thinking about selling because your current house is too big, too small, or because your needs have changed? If so, the year-over-year growth gives you more options for your home search. That means it may be less of a challenge to find what you’re looking for.

So, if you were holding off on selling because you were worried you weren’t going to find a home you like, this may be just the good news you needed. Partnering with a local real estate professional can help you make sure you’re up to date on the homes available in your area.

2. You Still Won’t Have Much Competition When You Sell

But to put that into perspective, even though there are more homes for sale now, there still aren’t as many as there’d be in a normal year. Remember, the data from Calculated Risk shows we’re down nearly 40% compared to 2019. And that large a deficit won’t be solved overnight. As a recent article from Realtor.com explains:

“. . . the number of homes for sale and new listing activity continues to improve compared to last year. However the inventory of homes for sale still has a long journey back to pre-pandemic levels.”

For you, that means if you work with an agent to price your house right, it should still get a lot of attention from eager buyers and could sell fast.

Bottom Line

If you’re a homeowner looking to sell, now’s a good time. You’ll have more options when buying your next home, and there’s still not a ton of competition from other sellers. If you’re ready to move, let’s connect to get the ball rolling.

Category Archives: Real Estate

The Truth About Down Payments

If you’re planning to buy your first home, saving up for all the costs involved can feel daunting, especially when it comes to the down payment. That might be because you’ve heard you need to save 20% of the home’s price to put down. Well, that isn’t necessarily the case.

Unless specified by your loan type or lender, it’s typically not required to put 20% down. That means you could be closer to your homebuying dream than you realize.

As The Mortgage Reports says:

“Although putting down 20% to avoid mortgage insurance is wise if affordable, it’s a myth that this is always necessary. In fact, most people opt for a much lower down payment.”

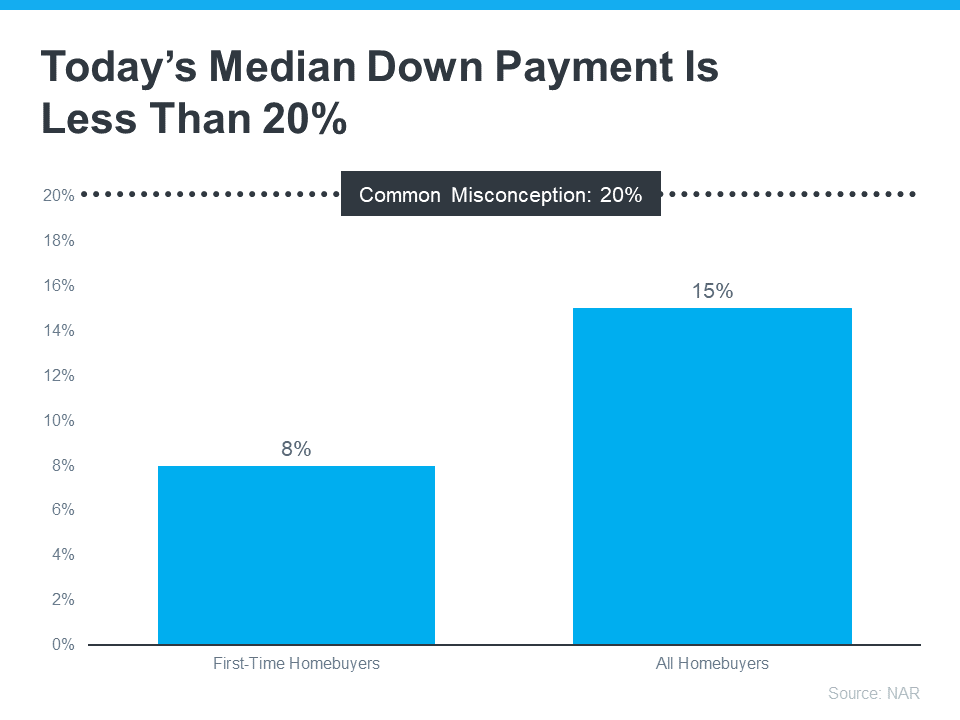

According to the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. In fact, for all homebuyers today it’s only 15%. And it’s even lower for first-time homebuyers at just 8% (see graph below):

The big takeaway? You may not need to save as much as you originally thought.

Learn About Resources That Can Help You Toward Your Goal

According to Down Payment Resource, there are also over 2,000 homebuyer assistance programs in the U.S., and many of them are intended to help with down payments.

Plus, there are loan options that can help too. For example, FHA loans offer down payments as low as 3.5%, while VA and USDA loans have no down payment requirements for qualified applicants.

With so many resources available to help with your down payment, the best way to find what you qualify for is by consulting with your loan officer or broker. They know about local grants and loan programs that may help you out.

Don’t let the misconception that you have to have 20% saved up hold you back. If you’re ready to become a homeowner, lean on the professionals to find resources that can help you make your dreams a reality. If you put your plans on hold until you’ve saved up 20%, it may actually cost you in the long run. According to U.S. Bank:

“. . . there are plenty of reasons why it might not be possible. For some, waiting to save up 20% for a down payment may “cost” too much time. While you’re saving for your down payment and paying rent, the price of your future home may go up.”

Home prices are expected to keep appreciating over the next 5 years – meaning your future home will likely go up in price the longer you wait. If you’re able to use these resources to buy now, that future price growth will help you build equity, rather than cost you more.

Bottom Line

Keep in mind that you don’t always need a 20% down payment to buy a home. If you’re looking to make a move this year, let’s connect to start the conversation about your homebuying goals.

Category Archives: Real Estate

Expert Home Price Forecasts for 2024 Revised Up

Over the past few months, experts have revised their 2024 home price forecasts based on the latest data and market signals, and they’re even more confident prices will rise, not fall.

So, let’s see exactly how experts’ thinking has shifted – and what’s caused the change.

2024 Home Price Forecasts: Then and Now

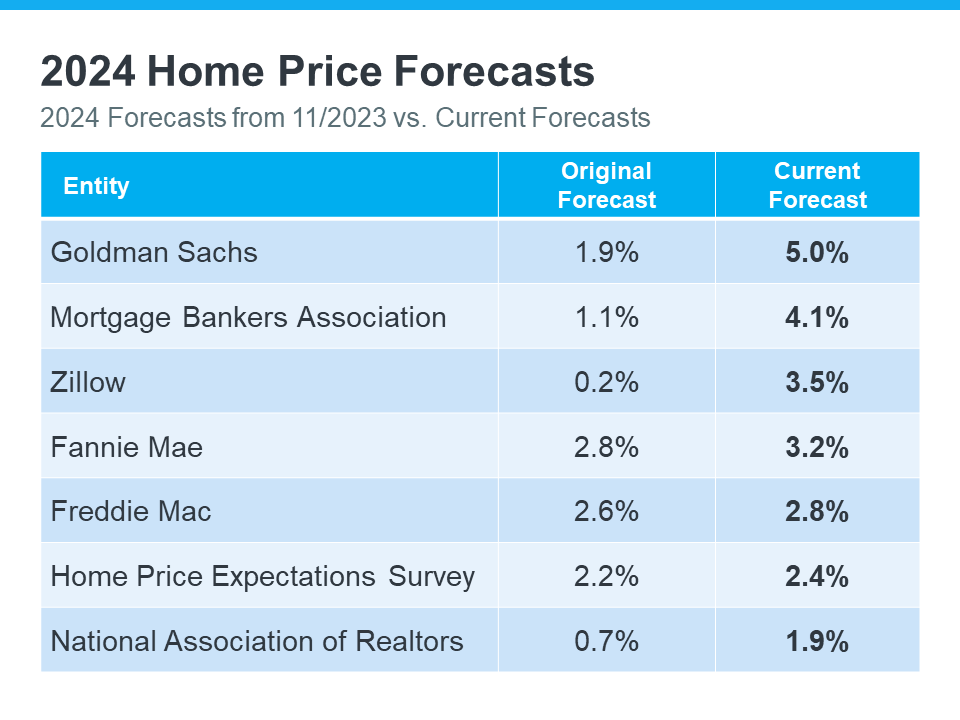

The chart below shows what seven expert organizations think will happen to home prices in 2024. It compares their first 2024 home price forecasts (made at the end of 2023) with their newest projections:

The middle column shows that, at first, these experts thought home prices would only go up a little this year. But if you look at the column on the right, you’ll see they’ve all updated their forecasts and now think prices will go up more than they originally thought. And some of the differences are major.

There are two big factors keeping such strong upward pressure on home prices. The first is how few homes are for sale right now. According to Business Insider:

“Low home inventory is a chronic problem in the US. This has generally kept home prices up . . .”

A lack of housing inventory has been pushing prices up for a long time now – and that’s not expected to change dramatically this year. But what has changed a bit is mortgage rates.

Late last year when most housing market experts were calling for home prices to rise only a little bit in 2024, mortgage rates were up and buyer demand was more moderate.

Now that rates have come down from their peak last October, and with further declines expected over the course of the year, buyer demand has picked up. That increase in demand, along with an ongoing lack of inventory, is what’s caused the experts to feel the upward pressure on prices will be stronger than they expected a couple months ago.

A Look Forward To Get Ahead of the Next Forecast Revisions

Real estate experts regularly revise their home price forecasts as the housing market shifts. It’s a normal part of their job that ensures their projections are always up-to-date and factor in the latest changes in the housing market.

That means they’ll continue to revise their projections as the housing market changes, just as they’ve always done. How those forecasts change next is anyone’s guess, but pay attention to mortgage rates.

If they trend down as the year goes on, as they’re expected to do, that could lead to more buyer demand and even higher home price forecasts.

Basically, it’s all about supply and demand. With supply still so limited, anything that causes demand to go up will likely cause prices to go up, too.

Bottom Line

At first, experts believed home prices would only go up a little this year. But now, they’ve changed their minds and forecast prices will grow even more than they originally thought. Let’s connect so you know what to expect with prices in our area.

Category Archives: Real Estate

Glenn Family Finds Hope Far From Home

During a sonogram at 15 weeks, Jeanie and Shaun Glenn of Seward, Alaska, found out their baby’s heart was off center. Additional tests eventually revealed congenital diaphragmatic hernia (CDH) with the liver, spleen, stomach and a portion of intestines all squeezed above the diaphragm into the chest cavity.

“Our doctor told us, if you want this baby to live, you need to seek care at an expert center,” recalled Jeanie.

The Glenns searched to try to find the best center to treat their unborn baby with CDH.

“Our thinking was that if we had to leave home anyway, we might as well pick a hospital which is known to have the best outcomes and extensive experience in treating CDH,” Jeanie said.

They chose Texas Children’s Fetal Center, and Jeanie’s doctor began coordinating care with Dr. Oluyinka Olutoye and Dr. Darrell Cass, former co-directors of the Fetal Center.

Jeanie underwent extensive prenatal evaluation which included ultrasound and echocardiography studies which revealed severe left-sided CDH. Mother and fetus were followed closely until 37 ½ weeks, at which time labor was induced due to concerns about fetal distress and poor growth.

Shaun, still working in Alaska, made it to Houston with just three hours to spare before baby John was delivered by emergency cesarean section due to a decrease in his heart rate. Weighing just 4 pounds, 9 ounces, John immediately went on a ventilator to support his severely underdeveloped lungs. John was treated with what is known as a “gentle ventilation” approach and a number of medicines to optimize the heart and lung function. His condition stabilized and then slowly started to improve. Remarkably, extra corporeal membrane oxygenation, a treatment for the most serious cases of heart/lung failure, was avoided.

At just five days old, Dr. Cass performed surgery on John in the NICU, a strategy pioneered at Texas Children’s Hospital. The liver, spleen, stomach and intestines were carefully removed from the chest and placed into their normal spots. John was born with almost no diaphragm muscle on the left side, and thus the repair required the use of a large patch to close the hole.

John slowly recovered. After 100 days in Texas Children’s NICU, the Glenns flew back to Seward with John on oxygen. He has had a couple of scares since moving back to Alaska, but overall John is progressing remarkably well given the severity of his initial diagnosis.

“We are incredibly lucky,” said Jeanie. “We picked Texas Children’s because they said that they would give our baby every chance, and that’s exactly what they did. All along the way, they never gave up. I don’t think John would be alive if we had not found the excellent care that we received at the Texas Children’s Fetal Center and Texas Children’s Hospital.”

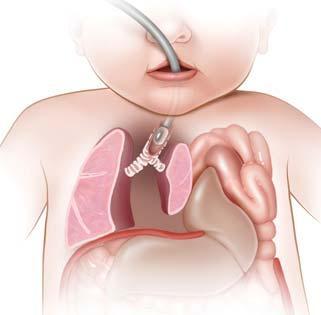

Fetal Endoscopic Tracheal Occulsion

Image

In addition to the excellent care John received, Texas Children’s Hospital is also able to provide treatment for the most severe cases of CDH under a research protocol approved by the Food and Drug Administration.

Fetal endoscopic tracheal occlusion places a tiny balloon in the trachea of the fetus in mid gestation to improve lung growth. The balloon is then removed later in the pregnancy to allow the baby be delivered normally.

The physicians and team at Texas Children’s Hospital have the most experience with this treatment modality in the United States and are currently evaluating and treating patients in this study.

Source: Texas Children’s Hospital